71,468+

CPE Credits Issued

3,000+

5-Star Reviews Generated for Accounting Firms

17,000+

Sales Calls Generated for Entrepreneurial Accountants

Are you experiencing any of this in your accounting firm?

You're probably... 😨

Struggling to pay yourself the salary you deserve.

Dealing with clients who only care about the lowest price.

Confused about which technology/software is the best for your firm.

Suffering from Shiny Object Syndrome, always chasing the latest thing with no results.

Lacking confidence to hire your first of next team member.

Wishing clients and prospects would recognize or appreciate your expertise.

Frustrated with how much time you're putting in compared to the money you're making.

Dreaming of having an online reputation that you're proud of instead of being annoyed by.

Disappointed (again) that the work you delegated wasn't up to your standards.

Overworking yourself during tax season with way too many hours for way too little profit.

Second guessing your self-worth and constantly battling 'impostor syndrome'.

Getting 👻'd after spending a ton of time creating a quote with nothing to show for it.

Overwhelmed, juggling your business and your family life.

Desperately wanting to move to an advisory model but don't know how to do it.

Having burn out set in with each passing day.

How We Serve You

Build

Click here to see our ‘done with you’ services to install PROVEN systems to get you more of your dream clients with less overwhelm.

Buy

Buy your dream accounting, bookkeeping, or tax firm. Click here to see our listings.

Sell

Ready for your next Chapter? Click here to see the Dream Firms Difference and list with us.

More than ‘just a community’

We treat our relationship as if we were non-equity partners in your firm and take a system-wide approach to scaling and improving your business by removing bottlenecks before they even come up.

Your goals are our goals, and your challenges are our challenges, and it’s our responsibility to solve those challenges using our proven playbook of solutions with our hands-on approach to implementation.

TLDR: We actually do things for you to build your dream firm, not just talk about doing things.

Answers, accountability, and assets are just a few clicks away.

TLDR: We actually do things for you to build your dream firm, not just talk about doing things. Answers, accountability, and assets are just a few clicks away.

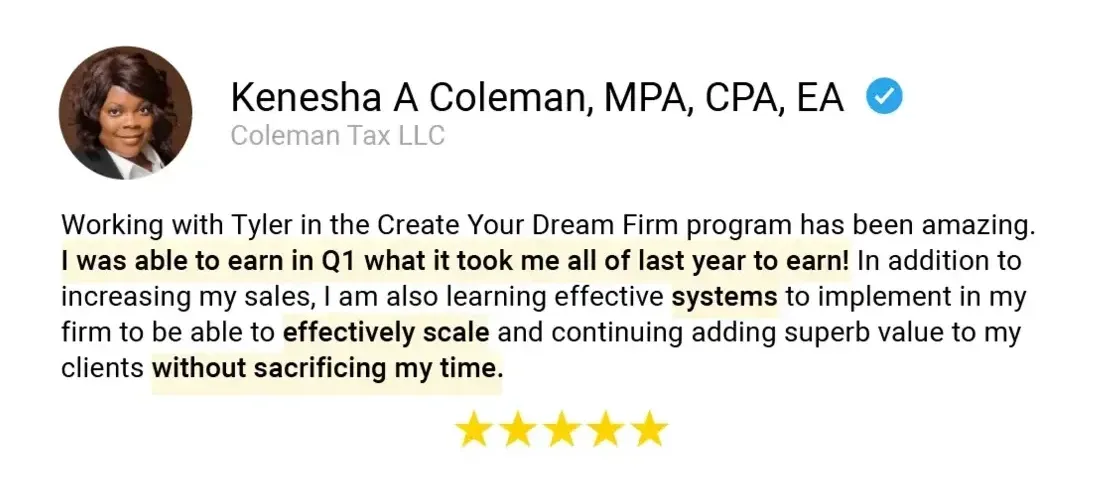

Audit Ready Reviews & Testimonials From Entrepreneurial Accountants

IMPORTANT: EARNINGS AND INCOME DISCLAIMER

All testimonials on this page are from real clients. The results you see on this page are not typical. Their experiences do not guarantee similar results. Individual results may vary based on your skills, experience, motivation, as well as other unforeseen factors. The Company has yet to perform studies of the results of its typical clients. Your results may vary.

FROM TAX SIDE HUSTLE TO FULL SERVICE FIRM

Tired of just barely getting by? Worried about what happens if your employer decides to cut ties? Alan pruitt of Pruitt Prep prepared for this eventuality, now he’s gone from $100,000 per year, to his first $100,000 month. (and he’s just getting started)

TRANSITIONING TO HIGHER VALUE SERVICES

You deserve to have your expertise recognized and invested in at a premium level, just like Enae. She was working too hard for people who didn’t respect her expertise or pay for her TRUE value. A few months inside the Create Your Dream Firm program and she’s working exclusively with her niche at an advisory level.

7-FIGURE FIRM OWNER ADDS $100K IN 4 WEEKS + AN 18X ROI

At this point, the game comes down to a single factor. You are the bottleneck in the growth of your firm. Your ability to delegate and make smart strategic decisions about client acquisition is the only thing preventing you from massive growth. Tom recognized this, and now he’s exploding like never before.

Build a Firm Where You Can Work On It, Instead Of In It

We know what drives the valuation of accounting firms to command higher multiples, so we focus on those and only those.

You use a premium pricing model

Filter out low quality clients with the simplest of strategies and boost profits.

You have a strong brand and unique value proposition

No more silly questions about 'why do you charge more than this other firm.'

You are specialized in a niche

That you excel in and are recognized as the go to expert in this area.

You have hyper-effective lead gen strategies

That are in place and delivering you a consistent flow of qualified leads.

You have a dream team working with you

Employees understand your vision and work efficiently.

You deliver a superior, hyper valuable service

That clients are excited to pay for every single month.

You track key performance metrics

Every decision is made with insights, not guess work.

You have industry leading client retention rates

Your clients love to work with you and know that you've got a wait list for new clients.

You have removed parasitic clients

And upsold existing clients to a profitable service package that perfectly suits their needs.

You have systems and tools in place for managing work

No longer allow for another deadline to creep up on you again.

You are more skillful in sales and negotiations

Follow simple rules and processes to establish a higher closing rate.

You have a clear and effective sales process

Never do an ounce of unpaid work again, or get ghosted on a proposal.

You have a firm capable of commanding a premium purchase price due to its high cash flow, advanced systems, dependable team, predictable lead generation, and significant profits.

Still on the fence?

Check out some in-depth case studies from our best clients!

IMPORTANT: EARNINGS AND INCOME DISCLAIMER

All testimonials on this page are from real clients. The results you see on this page are not typical. Their experiences do not guarantee similar results. Individual results may vary based on your skills, experience, motivation, as well as other unforeseen factors. The Company has yet to perform studies of the results of its typical clients. Your results may vary.

How An Accountant Added $165,000 Without Paid Ads

Without sacrificing his time or money, accountant Mark M. significantly increased his accounting firm's revenue.

CPA Finds The Formula To Generating Niche-Speaking Leads

Jon Neal just had his best tax season ever… That’s right, even though his accounting firm was down a team member, they were able to pull off their most profitable tax season ever. He's adding new accounting clients daily AND he's published a book.

How A CPA Added $74K Without Signing New Clients

CPA Zofia is attacking increases across the board. She’s spending less time working for her firm and earning more. And, she's added $74K in revenue without singing new accounting clients

Highest Revenue In Firm History: Interview with CPA James J.

From an army of one to a full-functioning and flourishing team, this is the story of how CPA and accounting firm owner James J. transformed his practice. He took back his time and cleared his highest revenue ever for Q1.

From Dead-End Job to A Flourishing CPA Firm

Today this CPA is generating $7 million, niche-specific leads. How did she get here? Via the Create Your Dream Firm program. Hear her story in her own words.

Accounting Power Couple Adds $80,000 In New Recurring Clients In JUST 4 Months

In this Create Your Dream Firm (CYDF) program review, learn how this accounting power couple was able to add $80,000 in NEW recurring clients in JUST 4 months! Here’s our exclusive interview with Dream Firm Leaders, Ken & Julie!

What are your other options?

We offer much faster results and a higher likelihood of success.

Here's Some More Proof

(From Our Dream Clients)

Here's Some More Proof (From Our Best Clients)

Because honestly, we have more proof than leftovers after thanksgiving.

IMPORTANT: EARNINGS AND INCOME DISCLAIMER

All testimonials on this page are from real clients. The results you see on this page are not typical. Their experiences do not guarantee similar results. Individual results may vary based on your skills, experience, motivation, as well as other unforeseen factors. The Company has yet to perform studies of the results of its typical clients. Your results may vary.

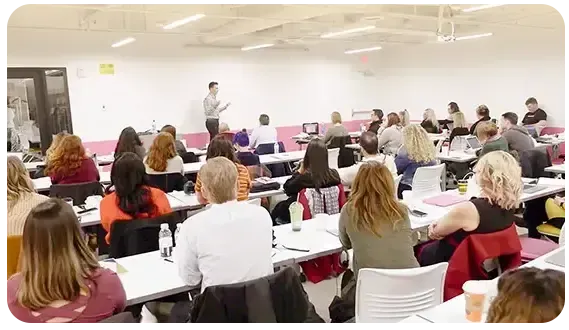

Don't Worry, You're In Good Hands

We’ve worked with 2,117+ entrepreneurial accountants, bookkeepers, and tax pros. There isn’t a challenge we haven’t seen, and solved. If you want the faster path to you running your firm rather than your firm running you, we’re here to help.

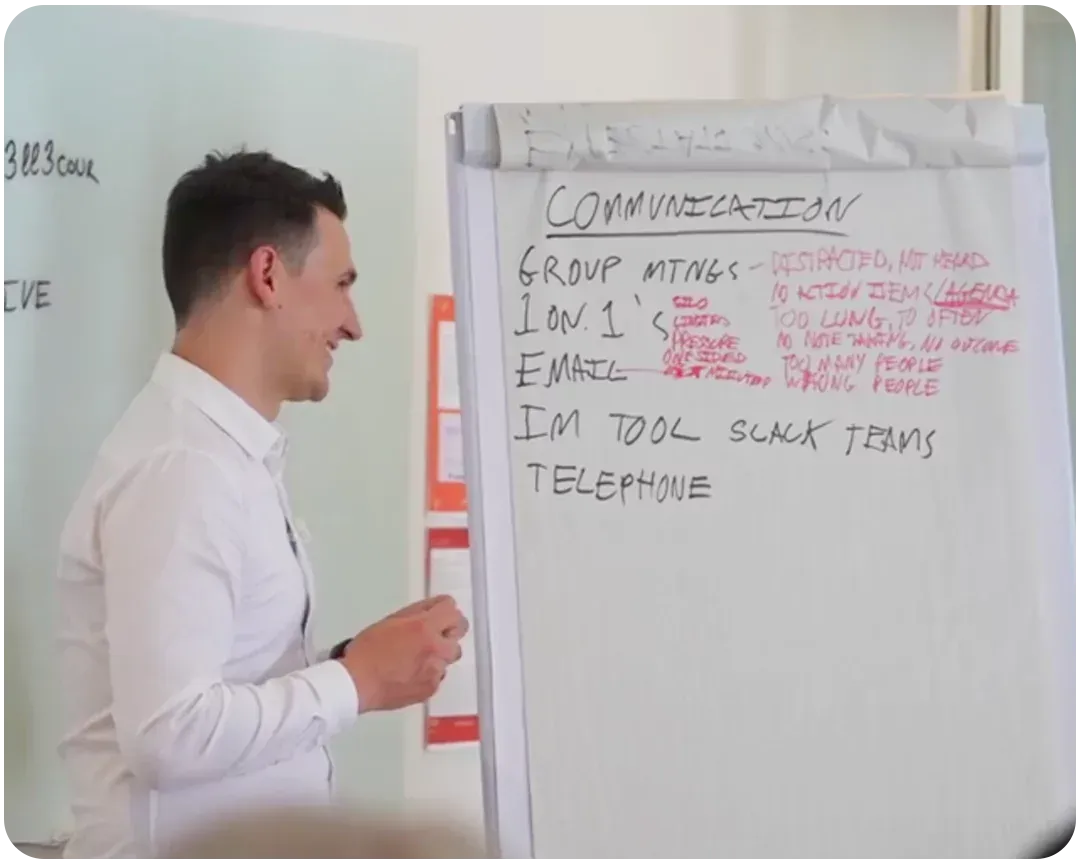

We’re going to be in the trenches with you, to elevate you from ‘doer’ to ‘director’ and finally from ‘director’ to ‘owner’ of your dream firm. It’s not an overnight thing, and while we like to dream big at dream firms we also want to keep it real but we also like to have fun in the process. Check out the photos below for proof we’re real, and our clients have a really great time in the creation of their dream firms.

A Letter From Our Co-Founder

A Letter From

Our Co-Founder

From the desk of Tyler S. Clark

Chappareillan, France

Clear blue skies

Monday November 4th, 2024

Re: Why you should consider us…

Love this question because if you weren’t a little bit skeptical I’d be worried.

It’s easy to make big promises, and increasingly easier to look good online with very little substance behind that those images and fancy words.

However it’s not easy to do the following:

Build and sell my own accounting firm.

Secure $100,000+ of new business for my accounting firm through non referral sources, and not through an acquisition. (and do it two years in a row)

Prove it wasn’t a fluke, or luck, by starting Dream Firms and taking a start up bookkeeping firm as our first client and getting them to $100,000 in new business in 10 months.

Prove it works for big fish, not just small fish, by taking a million dollar firm that took 30 years to reach this growth, and add another $1,000,000 in only 33 months.

Take a self proclaimed ‘overwhelmed, overworked’ solo-preneur accountant, and have them grow by $1.2 million dollars in 6 months.

Earn the respect of our clients so that they’ll travel internationally just for the opportunity to spend more time with us and our team. (The food and site seeing help, to be fair)

Have our clients renew, refer, and ascended because they’re seeing so much success.

Build a team of 15+ A+ players who are on the same mission: to generate $1 billion dollar of new wealth for our clients by 2034.

Receive 101+ 5 star reviews from our clients, and help our clients generate another 3,000+ 5 star reviews for their services.

Book 10,500+ appointments to connect accounting firm owners with their dream clients.

This is a small sample of what we’ve proven we’re capable of and if you want a dedicated, hungry team that’s proven to move mountains in your industry…

That’s what you get when you put the dream team behind Dream Firms, on your side.

We invest an unbelievable amount of resources into getting the attention of our dream clients, and then we invest significantly more into crafting the ideal customer experience for those brave enough to step out from behind the comfort of their spreadsheets and to become the leader required to have their dream firm.

Our goal is not just to make you more money, our goal is to transform you into the person you’ve always dreamed of being.

A final parting word, something that’s helped me and our top clients.

“The exact reason you’re saying you can’t do this, is the exact reason you need to do this.”

Remember, only YOU cant create your dream firm, but we’re here to help you every step of the way,

Tyler S. Clark

Co-Founder, Dream Firms

Frequently Asked Questions

Will this work for me?

If you’re an entrepreneurial accountant, tax professional, or bookkeeper with at least ONE PAYING CLIENT and you want to grow by AT LEAST $100,000 in the next 12 months, there is a very good chance we’ll be able to help you.

If you’re still unsure after seeing the ridiculous amount of proof on this page, we recommend taking it slower checking out our free educational resources, or, by getting your questions answered directly by our team of experts by scheduling a call.

While we can’t guarantee we can scale your business without any challenges (welcome to being an entrepreneur), we can guarantee we’ll do everything we can to make it as smooth a process as possible.

Is this just another coaching program or community for accountants?

No, while aspects of our service include community and direct forms of support, we’re not looking to shift the blame back onto our clients by only offering ‘do it yourself’ style content.

Entrepreneurial accountants suffer enough from ‘overwhelm,’ so we make it a point to provide step-by-step guidance and hands-on implementation services (i.e., we actually do things for you to speed things up and get you results faster) that create the results you’ve been looking for.

How much time do I have to commit?

Time is the ultimate resource of the entrepreneur. Your decision on how to invest it, directly correlates with your growth trajectory.

If you were investing your time optimally, you wouldn’t need to be on this page.

Our responsibility is to change how you’re investing your time, to change the outcome you want. The larger the outcome and the shorter the time frame you want it in, the more change required.

On average, our clients invest one hour per working day into our services excluding newly booked sales call. On average our top clients invest three hours per working day on working ‘on’ their firms but have gradually worked into this position overtime giving them full control over the direction of their firms.

(Working ‘on’ the business = building systems that provide future leverage, as opposed doing low level work that should be delegated which is working ‘in’ the business)

Do you teach high-pressure sales or the 'silent close'?

No! We believe in creating the desire to buy through a consultative sales approach, as opposed to creating unnecessary tension with outdated and ineffective high-pressure sales tactics.

I need help with pricing my services, do you help with that too?

Yes, our pricing strategies have simplified how our clients give quotes and ensure a high level of profitability for their firms without pricing themselves outside of consideration.

What is your success rate?

100% of those who implement.

Can you give me references/testimonials?

All of our references are available to you online right here on our website. However, we don’t give out our clients contact information because we respect their time and they’ve already been kind enough to write 5-star reviews. We will protect your time in the same manner once you become one of our top clients.

If you were so successful growing your own firm, why aren’t you still doing it?

I loved having my firm, but I had partners. As I am not a trained accountant, I was not responsible for fulfilling the promises our firm would make to our clients. The gentleman who was responsible for processing the work was a family friend for my entire life. He passed away suddenly going into our third tax season and it was a devastating blow to not only our firm but to our family. My father, the majority shareholder, decided to sell the business when this occurred. In the not so distant future, perhaps I’ll relaunch my accounting firm with a new fulfillment partnership in place.

Are you expecting me to do everything or do you actually help?

Fantastic question. Everything we offer is very much ‘done with you’. Ultimately, it’s your firm and we’re here to help you every step of the way to building it as efficiently as possible. That said, every relationship in the service business is a two-way street. You will need to do your part so that we can do ours. If you expect things to just happen without your direct involvement to build the firm of your dreams as you imagine it rather than getting forced into a box, you should look elsewhere. If you know that you’ll need to invest time and capital to get to where you want and want to do so as efficiently as possible, look no further.

What will my ROI be?

Great question, a counter-question is ‘what are you prepared to invest in terms of time and money to reach your growth goals?’ While you meditate on that, here’s a more direct response:

There are several types of returns you’ll experience.

The first of which is you will win back your most precious resource, your time because that’s the first thing our systems give back to you: The ability to get out of the minutiae of the day to day operations and go from ‘doer’ to ‘director’. As a direct result of being able to implement our proven systems, you’ll increase the number of high-quality leads generated, increasing the number of new clients you obtain.