Chat GPT For Accounting Firm Owners

How to Use Chat GPT for QuickBooks and Other ERPs

One of the biggest time savings that an accounting department can achieve is from better utilization of their accounting software. QuickBooks Online is one of the most widely used accounting solutions that can benefit from Chat GPT.

Finding out if you can import data into accounting software is always the top of our list of things to do to save time in an accounting department. It’s a go to first step, as many companies don’t integrate systems or have high levels of process automation which means that people are left typing data in from one computer system into another.

These are the top 5 ways that QuickBooks recommends to input data into QuickBooks faster. If we were to ask more clarifying questions, we could get even more precise results to take action with.

Try asking Chat GPT about how to automate your accounting software, with in-depth knowledge of Python, SQL, and advanced programming languages it could also be a great resource for Oracle, SAP, and significantly more complex accounting systems.

Using Chat GPT to Automate Financial Reporting For Accountants

One use case for accountants is to use Chat GPT as a resource in areas that you may not be as familiar with. The accounting industry has changed drastically over the last couple of decades. Accountants are increasingly being asked to automate their processes.

We absolutely believe that automation is the future of accounting. The elimination of manual data entry and manual financial report preparation reduces errors and improves the ability of management to make decisions with closer to real-time data.

However, these systems can be a lot to learn. They have gotten more approachable over the years but still require a level of technical knowledge on top of accounting knowledge. Chat GPT can be used as a resource for many popular business intelligence and analytic automation tools such as Power BI, Tableau, and Alteryx,

Can ChatGPT Pass The CPA Exam?

Example CPA Exam Question: Provide a summary of what is considered part of the required supplementary information for general purpose external financial reporting of a local government?

Chat GPT-4 Answer: The Required Supplementary Information (RSI) for general purpose external financial reporting of a local government typically includes the following elements:

- Management’s Discussion and Analysis (MD&A): A narrative overview of the local government’s financial performance, financial position, and significant changes during the fiscal year.

- Budgetary Comparison Schedules or Statements: A comparison of the original and final budget with actual revenues and expenditures for the general fund and major special revenue funds with a legally adopted annual budget.

- Schedules of Funding Progress and Employer Contributions: Information about the funding progress of defined benefit pension plans and other post-employment benefit (OPEB) plans, as well as the annual required employer contributions.

- Notes to RSI: Additional information or explanations to help users understand the RSI schedules and tables.

- Infrastructure Reporting (if applicable): Schedules and disclosures related to the condition and maintenance of infrastructure assets for local governments using the modified approach for reporting infrastructure assets.

These elements provide users with essential information to better understand a local government’s financial condition, performance, and accountability.

It’s an impressive answer. We had to ask the chat bot to provide a summarized answer for the sake of this post because it went into too much detail.

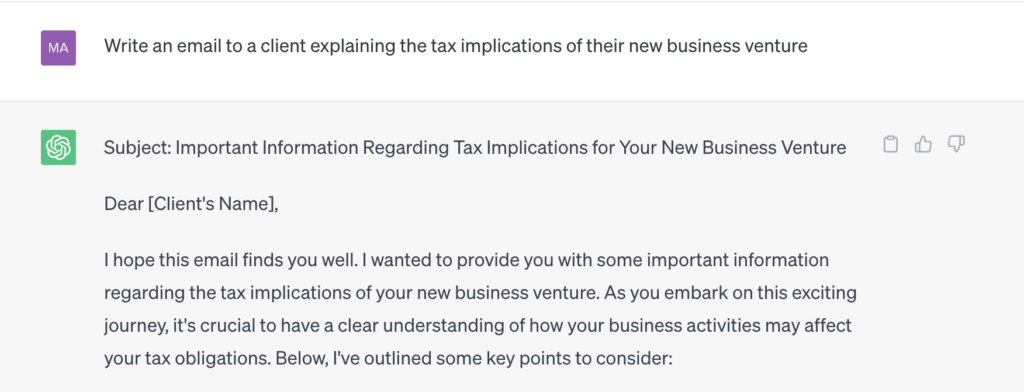

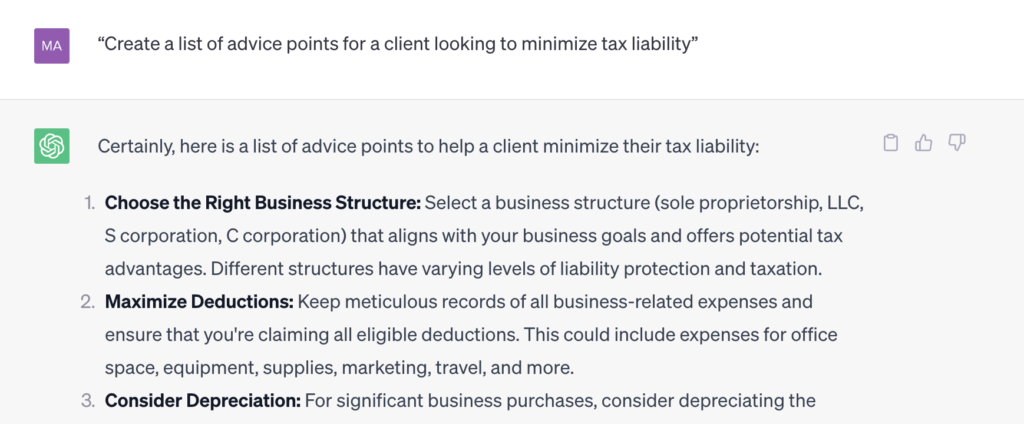

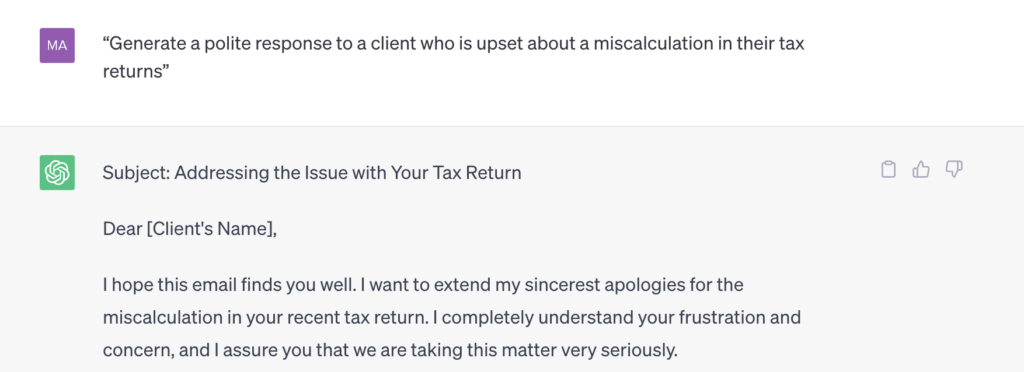

Communication is Key

Engage with your clients more effectively using ChatGPT Prompts. Draft professional emails, responses to inquiries, and client updates in a fraction of the time it would typically take.

The world of accounting is rapidly evolving, and innovative solutions can significantly impact your firm’s success. That’s why we’re excited to introduce you to ChatGPT Prompts, a cutting-edge tool designed to revolutionize your firm’s efficiency and productivity.

Take Advantage of Tech

Optimizing your business processes and driving growth is simple with the help of technology and automation tools, like the workflow tool, Ignition. By leveraging Ignition, you can:

- Automate your billing and payment collection process, saving time and reducing errors.

2. Present professional and branded online proposals to potential clients, boosting your credibility and increasing your chances of closing deals.

3. Utilize automated engagement letters that clearly outline your services, pricing, billing frequency, and engagement terms.

Basically, Ignition simplifies client engagement, billing, and payment processes by providing a comprehensive solution in one place.

By collecting client payment details upfront in your proposals, you can eliminate the risk of non-payment. You and your team won’t be working on anything until the service is paid for… Once clients sign, Ignition takes care of everything from generating invoices and scheduling payments to minimizing accounts receivable challenges. Experience the convenience and efficiency of Ignition’s technology and automation tools, and empower your business to thrive in today’s fast-paced world. Build a future for your dream firm with streamlined processes and increased productivity.

Chat GPT- The Ultimate Assistant

As an esteemed accounting firm owner, you are well aware of the importance of staying ahead in today’s competitive business landscape. The world of accounting is rapidly evolving, and innovative solutions can significantly impact your firm’s success. That’s why we’re excited to introduce you to ChatGPT Prompts, a cutting-edge tool designed to revolutionize your firm’s efficiency and productivity.