What is the difference between a successful accounting firm owner and a struggling entrepreneurial accountant?

Accountants hold an invaluable skill set that every citizen and business owner requires. So why is it that so many accountants and accounting firms are unsuccessful? There have been many, many studies done to try and quantify what makes one person (with the same skillset) more successful than another. Those studies found that successful people, and in particular accounting firm owners, share certain qualities. And shockingly when we compared those qualities with traits of the typical accountant, there was significant overlap.

By the way, though many accountants fall under the “introvert” umbrella, that doesn’t stop some from being incredibly successful. In fact, it can be a factor in their success. So saying you can’t sign new clients because you’re introverted won’t fly here. We know you can be a successful introverted accountant…

The Unexpected Trait Shared Successful Accounting Firm Owners

Success can be defined in many ways, but here, we’re talking about financial success. When we mention your dream accounting firm, we’re referring to a firm that uses automation efficiently and appropriately, has a steady influx of new clients, and generates profits without wasting your time. So, when we say success, that’s the type of end goal we want you to picture.

Let IMPOSTER SYNDROME Lead The Way

If you’re questioning yourself, you are on the right path… Imposter syndrome (or imposter phenomenon) is an internal psychological experience where one persistently doubts their abilities or accomplishments despite evidence proving the contrary. And it’s something many, many accounting firm owners deal with. As it turns out, it’s a good thing.

In their study “Overconfidence: A common psychological attribute of entrepreneurs which leads to firm failure.” The New England Journal of Entrepreneurship tried to determine whether a healthy sense of confidence was beneficial to business owners or not. You can probably guess their findings from the title of the article, but they discovered that too much confidence lead to bad choices and even worse results.

“It is then proposed that this overconfidence leads to errors in judgment that results in financial underperformance and failure found among most new ventures.”

If you’re dealing with imposter syndrome, embrace it but don’t let it rule you. Use it to identify your weak points and improve upon them. Don’t waste time wishing you were more confident, because that is much more likely to lead you astray. And remember, you know what you’re doing. The service you provide (tax filing, bookkeeping, CAS, all of the above) is invaluable and the right client knows that.

Why Imposter Syndrome Affects So Many Accountants

Imposter syndrome is a psychological phenomenon where individuals doubt their accomplishments and fear being exposed as frauds, despite evidence of their competence and success.

Imposter syndrome can affect accountants in various ways. Accountants often deal with complex financial matters and are responsible for providing accurate information and advice to their clients or organizations. Despite their expertise and qualifications, accountants may experience self-doubt and question their abilities. One factor contributing to imposter syndrome among accountants is the ever-evolving nature of this profession. Accounting practices and regulations constantly change, requiring accountants to stay updated and continuously learn new skills. This ongoing learning process can create feelings of inadequacy, as accountants may feel overwhelmed by the amount of knowledge they need to acquire and retain.

Additionally, accountants often work in high-pressure environments where accuracy and attention to detail are crucial. Chances are you often encounter situations where mistakes could have significant financial consequences. This pressure can intensify imposter syndrome, as accountants may fear making errors or believe that their past successes were mere luck rather than a result of their skills. Imposter syndrome can also be influenced by the comparison to others. Accountants might compare themselves to colleagues or professionals who appear more confident or accomplished, leading to feelings of inferiority or inadequacy.

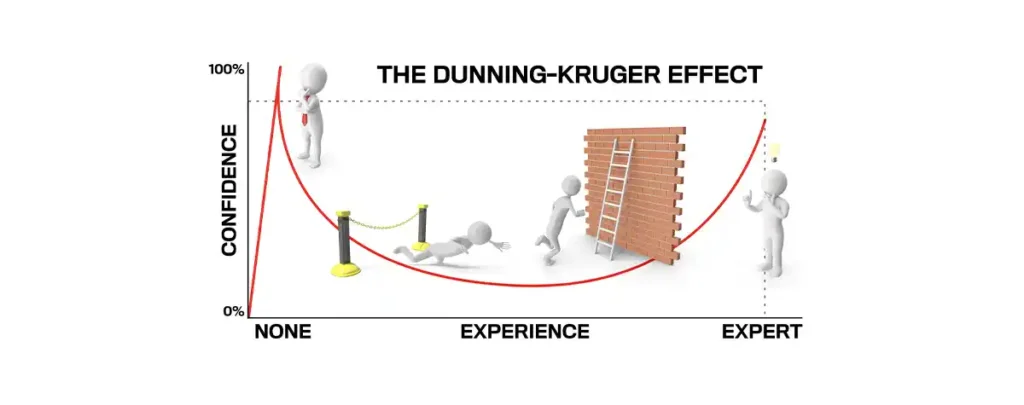

The Dunning-Kruger Effect

When someone starts their own accounting firm, they may have a limited understanding of the complexities and challenges that come with running an accounting firm. Despite their lack of experience, they might overestimate their capabilities and believe they have all the necessary skills to succeed. This overconfidence can lead to poor decision-making and a failure to recognize the knowledge and expertise gaps they have, even with years of experience as accounting professionals. On the other hand, accounting firm owners who have a deeper understanding of the intricacies of running an accounting practice may underestimate their own abilities and assume that their knowledge is common or easily attainable by others. This can lead to a lack of confidence in their own expertise and an underestimation of their value as owners and leaders within their firms. If you need help starting an accounting firm from scratch, check out our video with tips here.

While both situations can have negative consequences for accounting firm owners, the overconfident owner is in far more trouble. Overconfident owners lack the necessary skills or knowledge and make mistakes, overlook important aspects of their business, and fail to recognize the need for professional development. On the other hand, accounting firm owners who underestimate their competence typically hesitate to assert themselves or make strategic decisions. In this situation, a little bit of imposter syndrome might be exactly what you and your firm need to get on the right path.

How Accountants Can Overcome Imposter Syndrome

To overcome imposter syndrome, you have to acknowledge your accomplishments and abilities. Your qualifications, experience, and track record demonstrate your competence. And no one has the exact same skill set or experience as you. Seeking support from mentors or peers within the accounting profession can also be helpful. Sharing experiences and discussing challenges with others who have faced similar feelings can provide reassurance and perspective. It’s essential for accountants to embrace continuous learning and understand that knowledge gaps are opportunities for growth rather than indications of incompetence. Imposter syndrome is common among many professions, not just accounting. By acknowledging and addressing these feelings, accountants can develop a more positive and confident mindset, allowing them to thrive in their careers while recognizing their true worth and contributions.

Fighting Imposter Syndrome In Accounting

Regularly asses your strengths and weaknesses, seek feedback from clients, employees, and industry professionals, and invest in continuous learning and professional development. Seeking advice and mentorship from experienced professionals in the accounting industry or joining professional groups, like the Proactive Accountants, can also provide valuable insights and guidance. By actively engaging in knowledge-sharing and networking opportunities, accounting firm owners can gain a more accurate understanding of their own competence.